Peer 2 Peer FinTech Lending Software Platform

Designing, building, and deploying a Python/Django and React.js web application to enable investment and lending processes in a P2P lending network

Client

Fintech Startup FoundersSaudi Arabia

Project Duration

4 months5 people

Client Challenge

The client intended to build a multi-sided fintech platform to support an online lending community and thus to enable direct peer to peer lending between investors and borrowers.

The latter were meant to apply for and gain fast and easy access to loans / credits provided by the investor community active on the platform. The loans available for borrowers come with flexible payment terms and cover a varied spectrum of repayment schedules. On the other hand, individual and corporate investors can use the platform to earn regular Shariah compliant returns by choosing to support a pool of loans with a preferred risk profile, an accompanying return rate and an expected repayment plan.

Service Process

The client approached us with a project overview and well-crafted higher-level specifications of the overall system. We worked collaboratively with the client Product Owner to sequence the work for greatest business value, specify an MVP, develop more detailed specs for implementation as well as to design and develop the system in an agile/scrum process.

The client intended to build a multi-sided fintech platform to support an online lending community and thus to enable direct peer to peer lending between investors and borrowers. The solution needed to be designed and built in such a way as to ensure an appropriate level of confidentiality and security, with all sensitive data being encrypted.

The software system was built with the technology stack based on Python / Django and React.js. The application has also been fitted up with the functionality which enables parties to sign pdf documents on the platform.

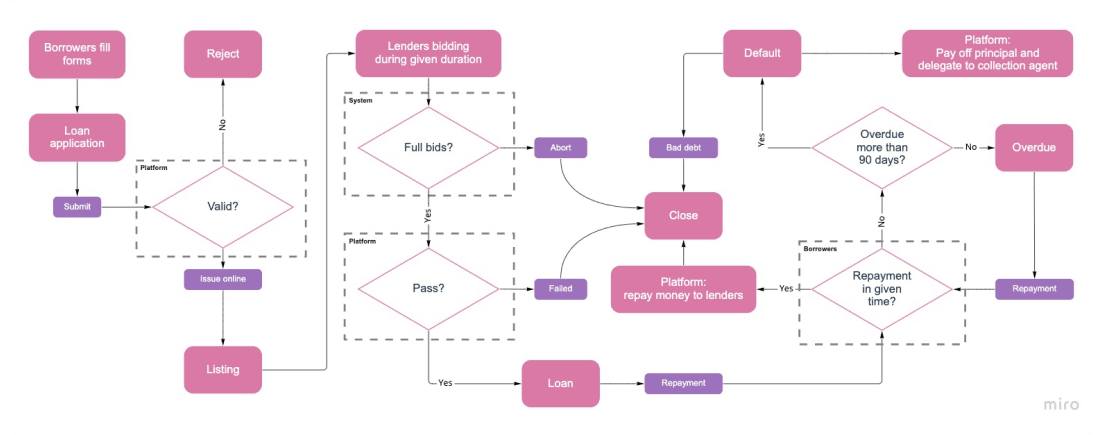

User Flows

Project Results

The solution was implemented based on the specifications delivered by and further developed together with the client. The software system supports the workflows of money lending and borrowing in the P2P lending community.

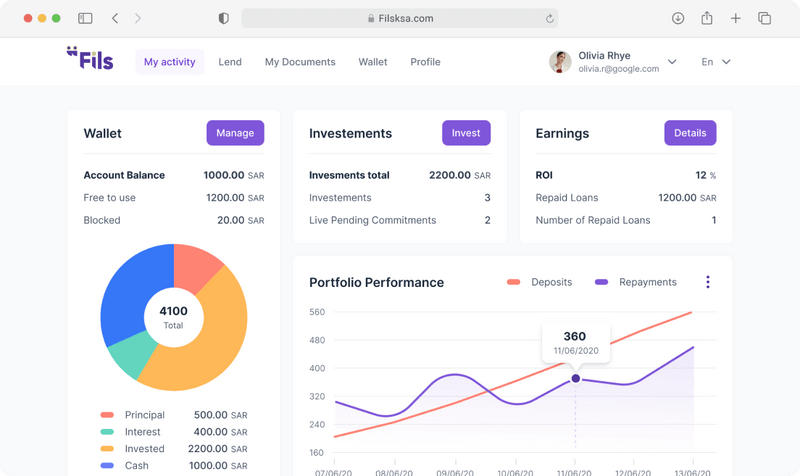

The borrowers register with multi-step forms and are evaluated for loan qualification. When the loans are granted to them, they repay the debt in multiple instalments in compliance with a predefined schedule. The borrowers can track their credit score as well as manage their loans and transactions with the Borrower Dashboard which is fitted up with some such functionalities as registration documents upload, loan capitalization status tracking, automatic email and sms repayment notifications.

On the other hand, the investors can review the submitted loan requests (including their credit scores), filter through them and choose loans to finance based on their preferred terms, risk tolerance and timeline. The lenders manage their investments and transactions online through a Lender Dashboard. They can execute transactions, review the status of loans on an ongoing basis as well as set automated notifications for investment opportunities or get alerted when due dates draw near. The web service was implemented to support both Arabic and English.

Deliverables

- mobile first web app built with Python / Django and React.js

- AWS services used for app hosting and data storage

- internally executed pdf document signatures

Benefits

- lenders provided with access to fast an easy loans online

- investors enabled to earn regular Shariah compliant returns

- convenient execution of processes, workflows and transactions in the P2P online lending community

Want to Learn More? Need a Project Quote?

Reach Out Today!

We're always ready to help

Blazej Kosmowski

CTO

Marek Petrykowski

CEO- Meet our seasoned engineering leaders

- Leverage our in-depth industry knowledge

- Get a free quote for your project